INTRODUCTION

EXPECTED IRR AFTER FEE ~11.5%P.A. , TARGET IRR BETWEEN 15%-20% P.A.*

Australia Hospitality Management Fund**

Invest in high quality and matured hotel business with improvement potential. The fund aims to generate good cash flow in the short term. And high capital growth from investment potential in the long term.

The Fund hold preferential shares in high-yield managed hotels and serviced apartments

A mix of 3.5 to 4 star quality hotels targeting various market segments, including domestic/foreign leisure and corporate guests; well balanced portfolio (and demand base) that delivers diversified income streams.

Operating income underpinned by experienced operators and a highly capable asset/investment management team with a track record of delivering strong investment performance.

FUND STRATEGY

The strategy of the fund is to provide investors with high yielding hotel business investment opportunities by the improved performance of operational hotels.

A stable and conservative approach which has already yielded a positive return, as well as providing a financial statement for past two years.

The fund invest in Adara managed hotels with solid proof of profitability with minimum of 2 years financial statement. The price we invest in will be no more than 4.5 times of the average profit over the last two years. The fund only invest in the hotel if all the conditions have achieved. The hotel must:

- have more than 15 years of lease agreement remaining.

- have body corporate sinking fund for building maintenance.

- have minimum of 40 keys

- have properly operated for minimum of 1 year and prove its outstanding profitability and audited by nominated auditors.

- keep the transaction price no more than 4.5 times of average net profit over the last 2 financial years.

FUND STRUCTURE

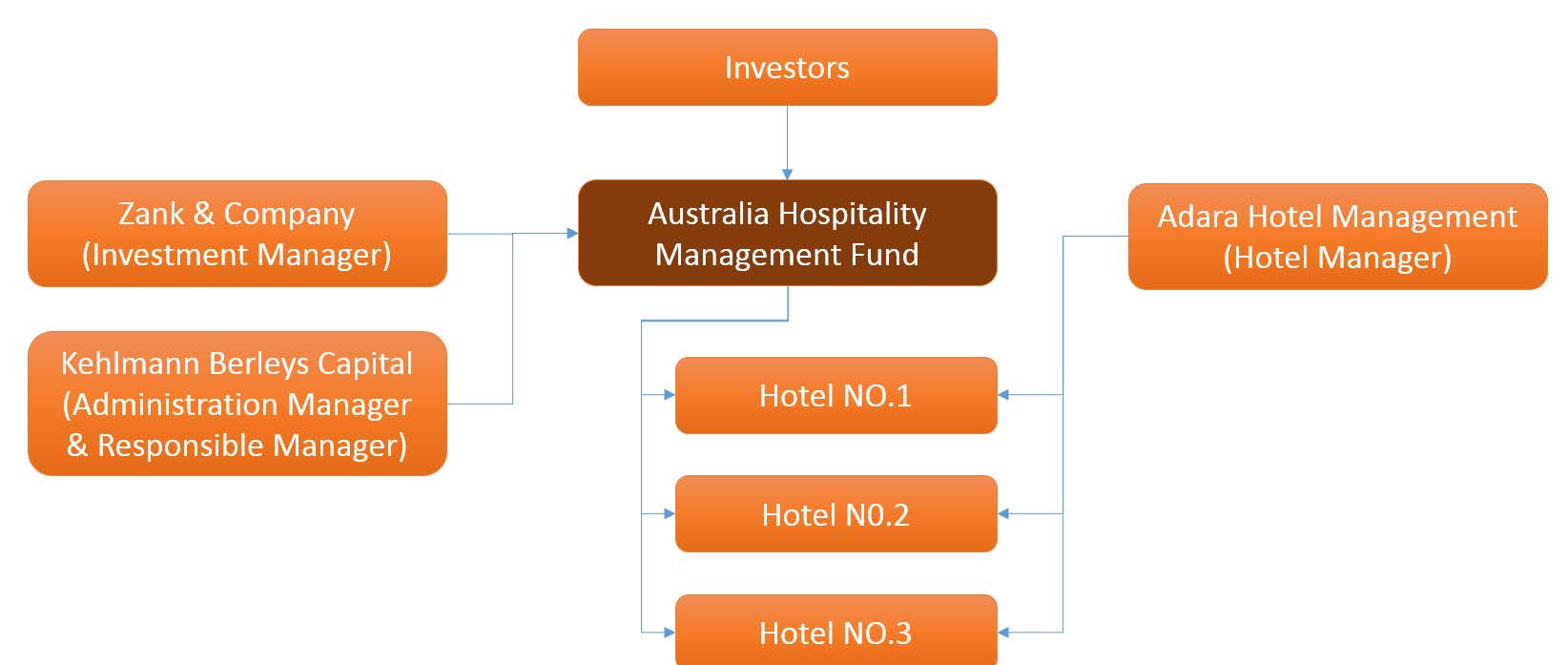

The Fund has been established to invest in Australia hospitality business. The diagram below illustrates the relationship between the parties in the Fund

The fund is an open ended fund structure, invested in preferential shares in each individual hotel. The unit price remains $1 each unit. Adara Hotel Management Company holds 10% ordinary shares in each managed hotel and the fund holds 90% preferential shares.

The investment structure has been established and seeded within the Zank Investors Group corporate structure.

DISTRIBUTIONS AND REPORTS

Distributions will be made before 10th July and 10th February of each year. All distributions will be made via electronic funds transfer to a nominated account. Reinvestment will not be applicable in this fund.

In addition to the distributions, Investors will be provided with:

- half-year financial reports

- annual reports and audited financial accounts each financial year upon request

- annual taxation statement

The Fund is considered as illiquid funds, because all hotel is positive yielded. Therefore, the Fund has no cash reserve for any redemption. Any redemption request has to wait in queue until the another investor invest in the Fund.

RISK FACTORS

There are a number of risk factors that could impact on the financial performance of the Fund and, accordingly, the Distributions Which Investors are forecast to receive.

The Fund is exposed to general market movements, including, but not limited to, trends in international and domestic tourism money and share markets, fixed income, commodities, real estate and property, which may all be affected by a wide range of factors, some of which may behave irrationally. These events may include changes in economic, fiscal, social, technological, political, legal or accounting conditions, investor confidence and forces majeure.

Neither the performance of the Fund nor the security of your business capital is guaranteed. The investment strategy is to be executed on a best endeavours basis only.

The Manager does not promise that you will earn any return on your investment or that your investment will gain or retain its value. It is impossible in a document of this type to take into account the investment objectives, financial situation and particular needs of each potential investor, or to describe all of the possible risks that could impact your investment. Nothing in this Information Memorandum should be construed as a recommendation by the Manager or any other person concerning an investment in the Fund.

Prospective investors should examine the full content of this Information Memorandum and consult their professional advisors prior to any investment.

Investors should be aware that the Fund is at least a medium term investment. The investment considerations and risks of investment in the Fund are similar to the considerations and risks which would apply in their own right. Investors should be aware that the income to the Fund could be materially influenced by a number of factors, including those outside the control of the Manager.

Major investment considerations and risks include:

- any downturn in the economy in general may slow the growth in tourism spending and the growth in income from the hotels;

- an investment in the Fund should be viewed as an illiquid investment;

- there is no guarantee that a capital gain will be achieved and a capital loss is possible;

- interest rate variations may affect the forecast returns;

- neither the Manager, the Trustee, nor ASIC guarantee in any way the performance of an investment in the Fund or the repayment of any monies subscribed for that purpose;

- Hotel revenue may be affected by changes in tourism patterns, currency, exchange rates or the behaviour of competing hotels;

- the forecast income from an investment in the Fund is partially dependent on the ability of the Operators to run the hotels on a profitable basis;

- any amendments to statutes or regulations adversely affecting the Hotel or the impact of taxes, may affect the value of the Hotel, the distributions from the Fund or the tax position of Investors

- While the Manager is confident of arranging proper insurance for all risks associated with ownership of the Hotels which are normally insured, there is no certainty that such insurance will continue to be available or that premiums will not rise and this may affect the forecast income from the Hotels.

* The Return Rate is net of all fees and expenses of the Fund. Target IRR based on a forecast of future returns. Zank calculates the indicative rate by careful analysis of the Fund’s projected investment outcome and by considering factors such as forecast interest rates and the current industry climate. Actual rate of return paid to investors is determined by the amount of income earned by the fund (net of fees and costs). The actual paid rate may be more or less than the indicative rate.

**As we are a whole sale fund all our products are available for wholesale clients only.

INVESTMENT DETAILS

| Fund Manager | Zank and Company Limited ABN 22 167 559 364 |

| Trustee Company | Zank Capital Limited AFSL No 246943 |

| Hotel Manager | ADARA HOTELS APARTMENTS PTY LTD (ACN 618 782 522) |

| Distributions | Distributions will be made on July and January of each year |

| Management Fee | Up to 3.0% per annum (ex GST) of the Gross Asset Value |

| Performance Fee | 20% anything over 10% hurdle rate of total Fund returns |

| Trustee Fee | 0.3% per annum of the asset under management |