INTRODUCTION

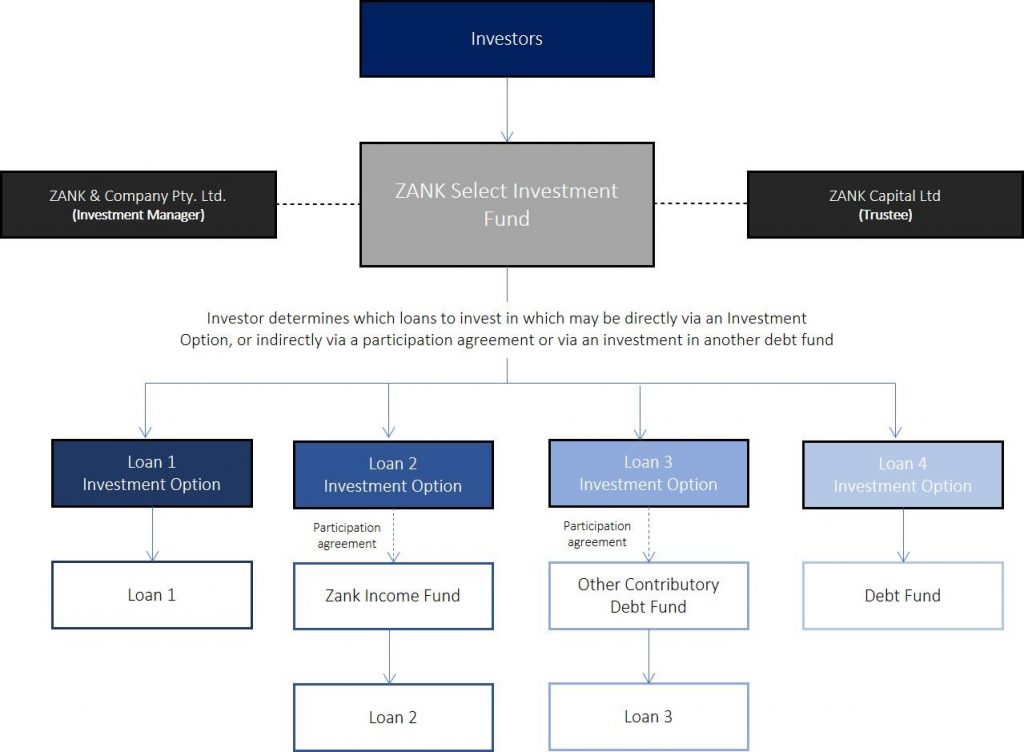

The Fund will provide Investors the opportunity to select from different Investment Options, each offering exposure to a different loan either directly made by the Fund or indirectly via a funded participation arrangement or an investment in another managed fund.

The commercial mortgage market in Australia is a highly regulated market, offering, by virtue of these regulations, greater protections for investors invested in debt funds. Zank is a non-bank commercial lender in Australia and has provided stable and predictable return since establishment in 2014. Zank Income Fund is its flagship retail investment product. The Zank Select Investment Fund will provide investors with a co-lending opportunity with our flagship product, via a participation arrangement with the Zank Income Fund, as well as some opportunities to invest directly into loans. Investors may choose which loans they wish to invest in. Importantly, investors exposure will be limited to the loan that the relevant Investment Option invests in and in no other loan.

The Zank Select Investment Fund is designed for Wholesale Clients who are primarily looking for discrete investment opportunities with clearly defined risks and returns.

An Investment Option Memorandum will be issued in respect of each Investment Option setting out investment specific details about the:

– Underlying Property

– Loan terms and security

– Minimum Investment Amount

– Target Return

– Investment term and withdrawal rights

The assets, liabilities and returns of each Investment Option will be separate from each other Investment Option.

FUND STRATEGY

Each Investment Option provides exposure to a different loan either directly made by the Fund, or indirectly via a funded participation arrangement or via an investment in another managed fund.

Specific details about each Property will be outlined in the Investment Option Memorandum for the Investment Option, as well as other investment details such as Target Return, security, investment term and withdrawal rights.

The Investment Manager maintains a set of Lending Guidelines it uses for assessing prospective loans to recommend to the Trustee on behalf of the Fund and for managing those loans once they are made. Below is a summary of some the key terms of the Lending Guidelines which may be adjusted from time to time depending on the Investment Manager’s risk assessment of the Fund’s existing portfolio of loans and prevailing market conditions.

FUND STRUCTURE

The Fund is an unlisted unregistered managed investment scheme structured as a unit trust and established by the Trust Deed dated 30 November 2020 which regulates the relationship between the Trustee and Investors.

The Trustee has appointed Zank & Company Pty. Ltd. as the Fund’s Investment Manager, having responsibility for, among other things, marketing the Fund and managing the Fund’s investments.

The monies contributed by Investors as application money will be pooled and invested in accordance with the investment strategy outlined in the Investment Option Memorandum for each Investment Option.

The assets and liabilities of each Investment Option are held independently of the assets and liabilities of other Investment Options and cannot be applied to the assets and liabilities of another Investment Option. Under the Trust Deed, each Investment Option is a separate Unit Class of the Fund.

The following diagram is for illustrative purposes only and demonstrates the structure of the Fund and relevant parties involved:

DISTRIBUTIONS

The frequency at which Distributions are expected to be calculated and paid will be outlined in the relevant Investment Option Memorandum for each Investment Option.

Distributions are generally paid to Investors within 30 days of the end of each distribution calculation period. However, Investors should note that distributions calculated as at the end of each financial year, being 30 June of each year, are likely to be paid by 30 September of each year, following the finalisation of the Fund’s annual accounts.

The amount of distribution income paid to you is based on the number of Units you held during the distribution period and how long you have held each Unit. This means that even if 2 unitholders each own 100 Units in the same Investment Option, if they have not held the Units for the same amount of time within that distribution period, their respective distribution entitlement will be different.

Please note if you are investing through a master fund or IDPS, the operator may pay income at different times and may not offer you a choice of payment options.

The Investment Option Memorandum of each Investment Option will set out the terms on which distributions are or can be reinvested.

RISK FACTORS

Like any investment, there are risks associated with investing in the Fund. There are a number of risk factors that could affect the performance of the Fund and the repayment of Investor’s capital. Many risk factors fall outside of the Trustee’s and the Investment Manager’s control and cannot be completely mitigated.

Please read the full Information Memorandum for the detailed risks.

None of the Investment Manager, the Trustee, Administration Manager, nor their associates or directors or any other person guarantees the performance or success of the Fund, the repayment of capital invested in the Fund or any particular rate of return on investments in the Fund.

INVESTMENT DETAILS

| Fund Manager | Zank and Company Limited ABN 22 167 559 364 |

| Trustee Company | Zank Capital Limited AFSL No 246943 |

| Administration Manager | Zank Capital Limited AFSL No 246943 |

| Distributions | The frequency at which Distributions are expected to be calculated and paid will be outlined in the relevant Investment Option Memorandum for each Investment Option. |

| Management Fee | Up to 1.5% per annum of the Fund’s Gross Asset Value |

| Performance Fee | 50% of any income received over and above the relevant target return disclosed in the relevant IOM |

| Trustee Fee | 0.5% per annum of the Fund’s Gross Asset Value |

THE Zank Select Investment Fund (FUND) IS AN UNREGISTERED MANAGED INVESTMENT SCHEME IN THE FORM OF AN AUSTRALIAN UNIT TRUST. THE FUND IS ONLY AVAILABLE TO INVESTORS THAT ARE WHOLESALE CLIENTS AS DEFINED IN S761G OF THE CORPORATIONS ACT 2001 (CTH) (ACT) OR SOPHISTICATED INVESTORS AS DEFINED IN S761G OF THE ACT.

ZANK & COMPANY PTY LTD IS THE INVESTMENT MANAGER OF THE FUND. ZANK & COMPANY PTY LTD IS A CORPORATE AUTHORISED REPRESENTATIVE OF ZANK CAPITAL LTD (AR NO. 001276430, AFSL 246943) ZANK & COMPANY PTY LTD ‘S AUTHORITY UNDER ITS CORPORATE AUTHORISED REPRESENTATIVE AGREEMENT WITH ZANK CAPITAL LTD IS LIMITED TO GENERAL ADVICE REGARDING THE FUND ONLY. ANY OTHER ADVICE PROVIDED IS NOT PROVIDED PURSUANT TO THIS AGREEMENT. ZANK CAPITAL LTD IS THE TRUSTEE OF THE FUND AND THE ISSUER OF ITS INFORMATION MEMORANDUM

THIS WEBSITE CONTAINS INFORMATION ABOUT THE POTENTIAL ISSUE OF INTERESTS IN THE FUND, BUT IT IS NOT INTENDED TO BE USED BY ANY OTHER PERSONS IN ANY OTHER JURISDICTION IF AND TO THE EXTENT THAT TO DO SO WOULD BE IN BREACH OF AUSTRALIAN LAWS, OR THE LAWS OF ANY FOREIGN JURISDICTION.

THIS WEBSITE CONTAINS GENERAL INFORMATION ONLY AND IS NOT INTENDED TO PROVIDE ANY PERSON WITH FINANCIAL ADVICE. IT DOES NOT TAKE INTO ACCOUNT ANY PERSON’S (OR CLASS OF PERSONS) INVESTMENT OBJECTIVES, FINANCIAL SITUATION OR PARTICULAR NEEDS, AND SHOULD NOT BE USED AS THE BASIS FOR MAKING AN INVESTMENT IN THE FUND. NEITHER ZANK & COMPANY PTY LTD NOR ZANK CAPITAL LTD MAKE ANY REPRESENTATION AS TO THE ACCURACY, COMPLETENESS, RELEVANCE OR SUITABILITY OF THE INFORMATION, CONCLUSIONS, RECOMMENDATIONS OR OPINIONS CONTAINED ON THIS WEBSITE (INCLUDING, BUT NOT LIMITED TO ANY FORECASTS MADE). NO LIABILITY IS ACCEPTED BY ANY OF THESE ENTITIES OR THEIR RESPECTIVE DIRECTORS, OFFICERS, EMPLOYEES, AGENTS OR ADVISORS FOR ANY SUCH INFORMATION, CONCLUSIONS, RECOMMENDATIONS OR OPINIONS TO THE FULLEST EXTENT POSSIBLE UNDER APPLICABLE LAWS.

THIS WEBSITE MAY CONTAIN FORWARD LOOKING STATEMENTS REGARDING OUR INTENT, BELIEF OR CURRENT EXPECTATIONS WITH RESPECT TO MARKET CONDITIONS. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. ZANK & COMPANY PTY LTD DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE ANY FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS AND CIRCUMSTANCES AFTER THE DATE OF THIS PUBLICATION.

NEITHER ZANK & COMPANY PTY LTD NOR ZANK CAPITAL LTD GUARANTEE THE REPAYMENT OF CAPITAL, THE PERFORMANCE OF ANY INVESTMENT OR THE RATE OF RETURN FOR THE FUND. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE PERFORMANCE.

List of Investment Options

Park Ridge, QLD

Target Return: 9 % p.a. net

TERM: 1yr

Completed

Doncaster, VIC

Target Return: 8.5 % p.a. net

TERM: 3+3 months

Completed

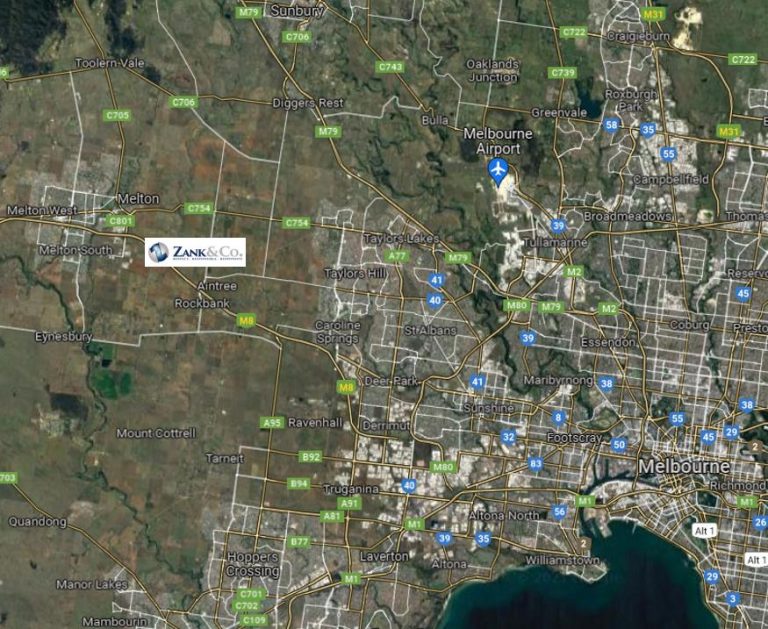

Melton East 2, VIC

Target Return: 8.0 % p.a. net

TERM: 18 months

Completed

Melton East, VIC

Target Return: 8.0 % p.a. net

TERM: 18 months

Completed

Augustine Investment Option

Target Return: 14 % p.a. net

TERM: 12-18 months

Funding Completed

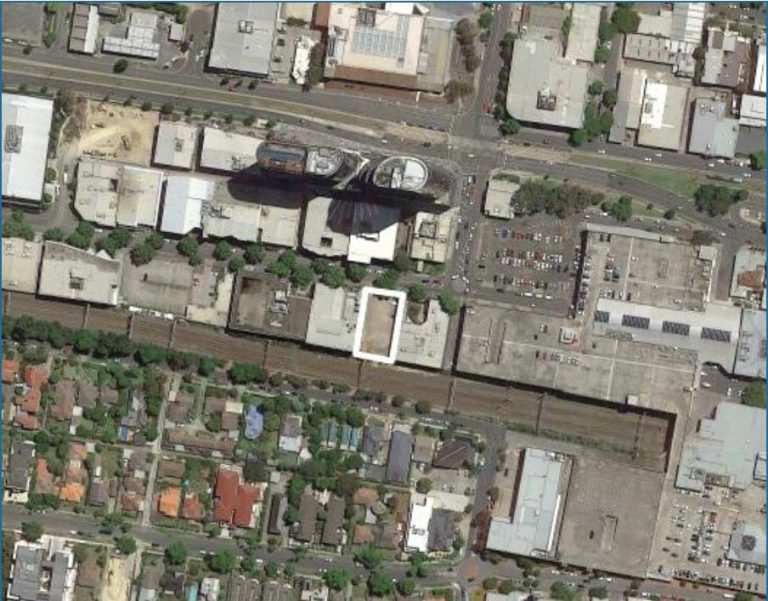

BOX HILL, VIC

Target Return: 8.2 % p.a. net

TERM: 12 months

Completed

Eltham Oak Investment Option

Target Return: 8.5 % p.a. net

TERM: 6 months

Completed

Officer VIC

Target Return: 8.5 % p.a. net

Term: 9 months

Completed